…that might have had something to do with our financial collapse? Barack Obama accepted the Democrat nomination, that’s what. That is also when the stock market took a dive and also when unemployment really kicked in to high gear. Look, I am no statistician or pollster or financial analyst, but when you look at the following charts I have assembled, it gives you pause. I thought at the time that at least part of the reason that things cratered when they did is that it became clear to Wall Street and businesses in general that we were about to elect an anti-business President and perhaps a Democrat majority in Congress. And, since businesses can’t afford to wait and see if they are right in these matters, they acted almost immediately in the face of the higher cost of doing business that was coming their way.

I used Rasmussen in the above shot because according to this analysis from Costas Panagopoulos of Fordham University, Rasmussen was the most accurate poll of the 2008 election. Sorry, I know that Rasmussen is evil and all, but he is also mostly correct.

Less than a month later on September 18, Henry Paulson and Ben Bernanke were asking Congress for carte blanche to deal with the imminent collapse of the whole damn global financial system and it was on like Donkey Kong. Here is a very nifty timeline of events back then, from Dipity:

You can probably see it better if you click through to Dipity. Also, scroll a bit to the left to see the beginning of the events. Dipity starts with September of 2008. Things really accelerate after August 28, don't they?

Next, from MSN Money is the Dow Jones, S&P and NASDAQ averages from February 2007 through February 2010. Note the highlighted points; the market cratered beginning at the end of August 2008.

Clearly, the market was already trending down by August, but right after the nomination everything fell off the cliff.

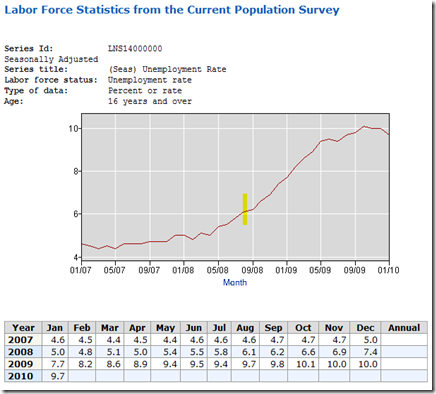

Finally, here is the unemployment trend from the Bureau of Labor Statistics:

Again, unemployment was trending upwards from about December 2007 on, but it accelerated dramatically after August 2008, increasing a full 1.3 percentage points from August to December of 2008. For the math-impaired, that was a 21 percent increase over that period of time, compared to an 8.6 percent increase over the same period in 2007.

I posit that the election of Barack Obama pushed the economy over the edge into panic mode. Investors wanted out of markets, companies knew they had to cut overhead and they all knew that they had to act quickly, before Obama and the Dems took office and imposed higher costs in the form of higher taxes, health care reform, cap and trade and because of the simple fact that modern Democrats in general and Obama in particular are essentially socialist in philosophy. Couple this with the deteriorating business conditions in general and the collapse was inevitable.

No, Obama’s nomination did not cause the financial deterioration of the economy. That was already underway. But it damn sure sped things up and made things worse. With his nomination and subsequent election, all hopes of a soft landing evaporated. Elections really do have consequences.

I put it this way: Imagine yourself as an investor in 2007, asking yourself "What will Democrats, progressive Democrats, do when they control everything?" Even as you are phrasing the queston you stop lending, because the answer is exactly what they have done: borrow, spend, tax, regulate, demonize business, champion unions, and spread massive amounts of FUD throughout the market.

ReplyDeleteYeah, I remember all those investors down on their luck during the Clinton administration.

ReplyDeleteGet off it, you're really reaching this this farce.

Really? I mean, really? Investors wait until Obama is formally nominated in August instead of pulling their cash out in June when Hillary conceded?

ReplyDelete"Investors wanted out of markets, companies knew they had to cut overhead and they all knew that they had to act quickly"

If by acting quickly you mean that they casually waited until the END of September and decided to panic and pull their cash out.

Certainly Obama was the catalyst for the markets plunging! The accelerated decline of the markets had much less to do with the collapse of Lehman, Wamu, Wachovia, AIG, Merril Lynch, and several smaller banks in between Obama's nomination (in August)and the eventual nosedive that the market took at the end of September.

Doesn't this sound a little convoluted to you? Maybe the complete fiscal unsoundness of these institutions and their collapse meant a little more to financial markets than who was nominated? Unless you're saying that all of these banks would have remained solvent longer if Hillary had won the nomination?

Have you ever heated water in a microwave? Sometimes, if conditions are just right, a funny (and dangerous) thing happens. The water gets superheated, but to the naked eye, it is not hot or boiling. But, the instant you put something in it, it will explode. Whatever you put in the water acts as a precipitant, giving the water something to react against.

ReplyDeleteIf a change in governance in the largest economy in the world is not a precipitating event, I don't know what is.